of the S&P 100

of the top asset

management firms

of the top

consultancies

of the top healthcare

companies

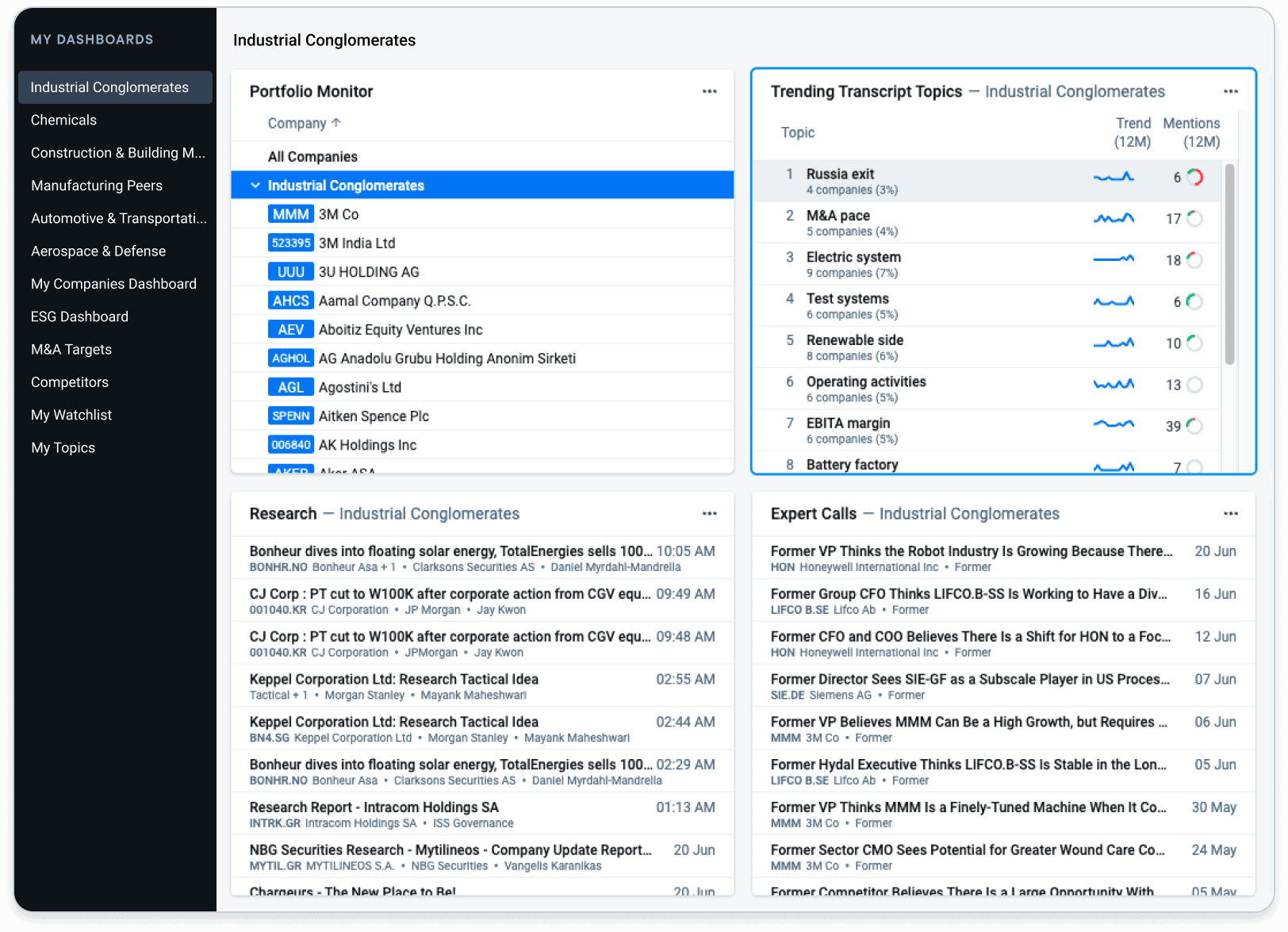

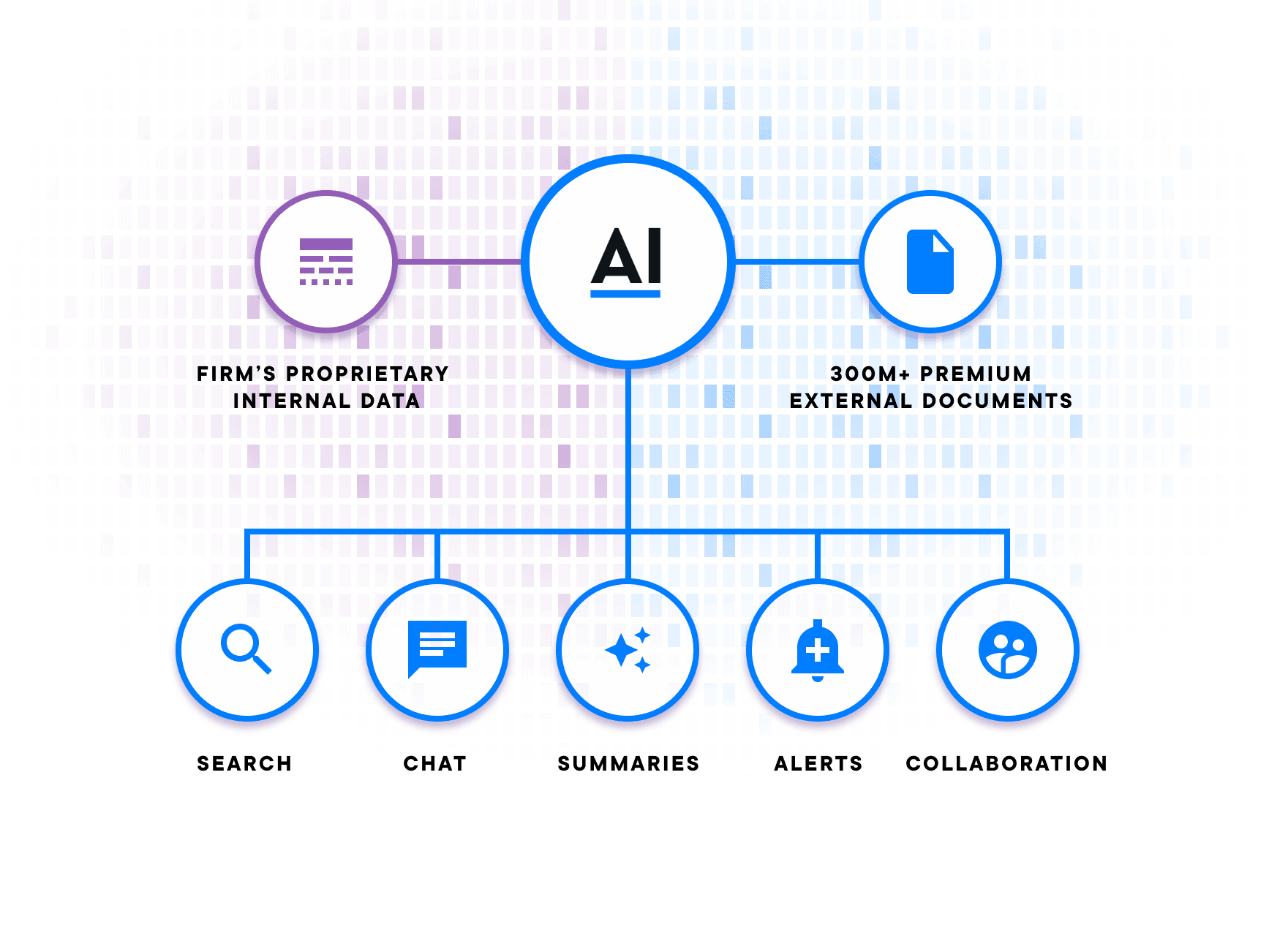

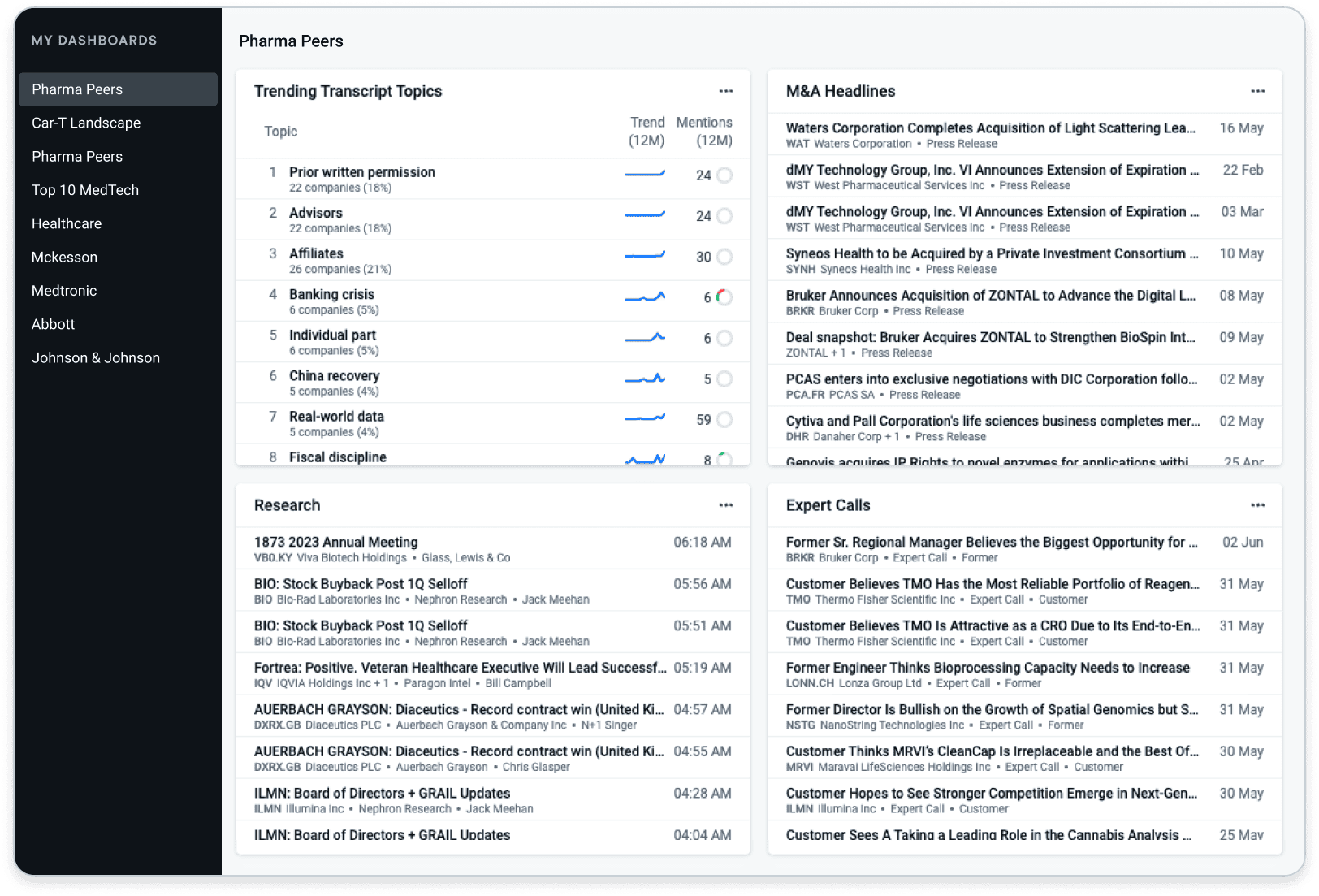

A powerful platform that works for you

Information is overwhelming—but it doesn’t have to be. We’ve spent over a decade refining our proprietary AI and NLP technology, so you can easily surface and track insights from millions of documents across earnings, broker research, expert calls, company documents, and even your own proprietary internal content——all in one place.

-

EXTENSIVE CONTENT LIBRARY

Search any company, industry, trend, or topic across 300M+ premium external documents or your firms proprietary internal content.

-

TIME SAVINGS

Let our AI technology do the work for you. Spend less time on time-consuming, manual tasks and more time on analysis.

-

AVOID BLIND SPOTS

Easily monitor and surface critical insights on everything you’re tracking in real time.

-

ENTERPRISE-GRADE SECURITY

Protect your company’s data with the highest industry standards—including zero trust security model, modern authentication practices, and secure data encryptions.

All the perspectives you need in one place

MARKET INTELLIGENCE

Search any company, industry, trend, or topic across company filings, broker research, expert calls, regulatory docs, press, and more to get all the market perspectives you need.

Learn more

Trusted by thousands of the world’s top financial institutions and corporations

Financial Services

There’s a reason we’re rated #1 in Financial Research. In an increasingly uncertain market, the last thing you need is FOMO. Be the first to strike on critical changes or market-impacting trends affecting private and public companies.

Corporate

Legacy research tools are littered with blind spots. Whether you’re launching a new product, providing intel to key executives, or making pipeline decisions, our proprietary AI technology ensures you make moves with confidence and ease.

Find out how real companies make real decisions with AlphaSense

Get started today

The world’s leading corporations and financial institutions—including a majority of the S&P 500, over 85% of the S&P 100, and 75% of the top asset management firms—trust AlphaSense for smarter, faster decisions.

What our customers are saying

AlphaSense: Transforming Market Insights

AlphaSense helps me to efficiently search for information on companies and their products for my strategy consulting business. I was looking for a reliable revenue estimate of a private company so I could make a punchy company profile slide for my client. Upon, searching AlphaSense, I not only got crunchbase/owler estimates, I was able to find Moddy’s investor rating on the company’s outlook…. Read the full review on TrustRadius

-Aruna Rajan, Founder and CEO